Avelon Zero

An AI system that trades — and delivers.

Live portfolio, real capital. Averaging +10–20% monthly growth since July 2025 — no leverage, no paper trading. Each week we share the exact positions and performance.

Powered by a network of autonomous AI agents that scan thousands of stocks, decode catalysts, and predict short-term moves before the crowd sees them.

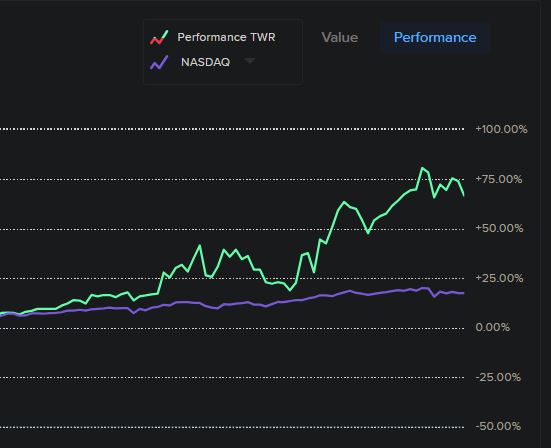

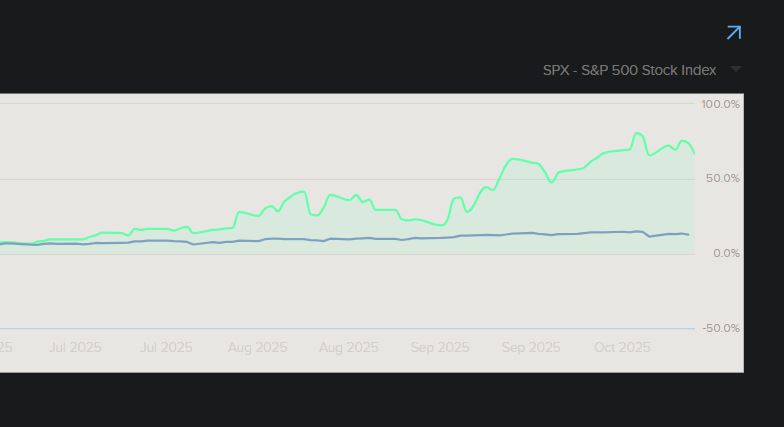

Performance snapshot

Live performance. Fully transparent.

This system trades real capital — no paper accounts, no leverage.

Since July 2025, it has delivered consistent +10–20% monthly growth with controlled volatility and minimal drawdowns.

Each trade is executed in a live IBKR account, tracked and timestamped for verification.

You can see the current portfolio, positions, and equity curve — exactly as they are.

Excerpts below:

Live IBKR portfolio performance vs S&P 500 and NASDAQ — July to October 2025 (verified account excerpt).

We never take deposits or manage client funds — we only share our own trades.

What's in it for you

Built so you can act instantly.

Each week we publish every trade our AI system makes — entries, exits, and position sizes — so you can follow along or copy them manually if you choose.

No coding, no bots, no noise.

You simply see what's live in our portfolio and decide whether to mirror it.

Same trades. Same timing. Zero complexity.

Inside the system

Hundreds of AI agents work together inside a living research network.

Some scan thousands of tickers. Others decode news, predict volatility, or test hidden links between events and price moves.

No one agent knows everything, but together they see what humans miss.

You don't need to understand how it works. You'll feel it when you see the results.

Why it works

Markets reward clarity and timing.

Our AI models track market data and company events to find positions with strong short-term potential. When the signal weakens, we step back — simple rules, consistent discipline.

- Focus

- Equities and options with high expected growth.

- Update cycle

- Weekly system re-evaluation.

- Risk control

- Limited exposure, no leverage.

About

We trade what we build.

We're independent researchers with years of experience in technical analysis, machine learning, and AI forecasting. Every iteration of the system is tested with live capital — we document the wins, drawdowns, and evolving playbook so you can follow the edge as it develops.

Disciplines

- Systematic trading research

- Machine learning for market inference

- Agentic workflow orchestration

- Risk-management automation

Disclaimer

This publication is for informational and educational purposes only. It does not provide financial advice, investment recommendations, or any offer to buy or sell securities.

Past performance does not guarantee future results.